Engagement Summary

As part of a large-scale restructuring in 2020, a market-leading investment bank’s Prime Brokerage division approached Monticello Consulting Group to support the design and implementation of a merger of their two key business entities. The goal of this ambitious effort is to optimize redundant and inefficient processes to achieve significant operational costs savings and accelerate services innovation. The strategic aim of the merged entities is to offer its clients a set of unique and differentiated services that better that of the competition.

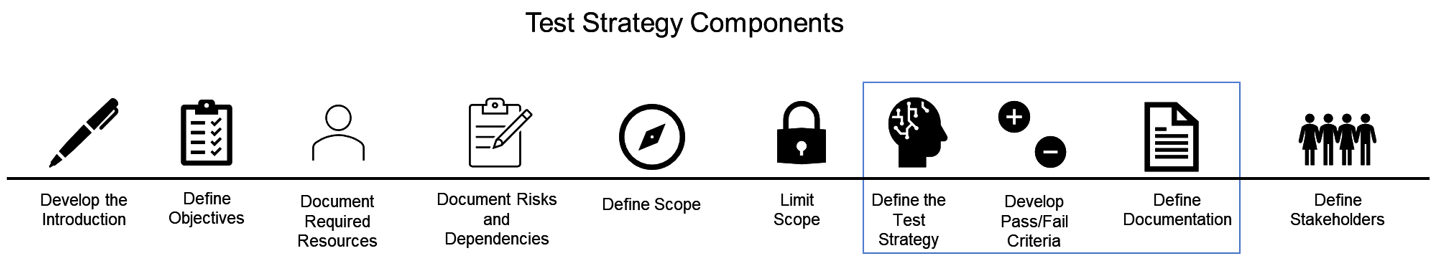

Following the development of the target state infrastructure, Monticello Consulting Group was trusted to support integrated testing. To facilitate this effort, the team developed an agile test framework through a comprehensive understanding of test strategy and test schedule, and with guidance from a strong Test Governance Office (TGO). In doing so, MCG was able to de-risk the project at an early stage and allow the client to meet its ambitious testing milestones.

Case Study Detail

TESTING GOVERNANCE OFFICE (TGO)

Prior to test planning, it was important to establish an agile Test Governance Office with clearly defined roles and responsibilities for central coordination of integrated testing, issue resolution, and escalation. An agile framework ensures each deliverable is mapped back to business goals, thus promoting a higher level of visibility into not only testing progress but the incremental business value-add. A set of well-defined test strategies, grounded policies, principles, and controls are integral to the successful operation of any testing governance framework. The TGO established standard project templates, tools, reporting, and terminology to enable effective and consistent insights, and to foster clarity and transparency across integrated testing. Further, this approach allowed the team to better manage critical defects, risks, and dependencies from the outset and more easily respond to change in real-time.

TEST PLANNING

With direction from the Test Governance Office, each sub-project was responsible for developing respective test planning documents. Sub-projects first defined the testing universe by leveraging the business requirements document (BRD) developed during the project’s planning phase. As with most projects, the testing scope should be grounded in a project’s requirements. More specifically, utilizing the templates provided by the TGO, the team identified the scope of systems impacted and considered all the merger’s relevant tech and non-tech activities to aid the development of functional testing scenarios. We further cataloged systems to delineate between functional testing and regression testing to help sequence activities, which would be beneficial when creating the test schedule. For each scenario, we subsequently detailed high-level steps test orchestration steps, expected results, and provided validation criteria. To mitigate the challenges of end-to-end testing in lower-level environments, and to facilitate early integrated testing of critical functionality, each sub-project also identified test neighborhoods. These neighborhoods, or key change areas, along with testing dependencies, including test data needs, test environments, and any sub-project interdependencies, were added to our testing models and ultimately fed back into the Test Governance Office for aggregation.

After the comprehensive testing models were formulated, the sub-projects were then ready to develop robust testing timelines. Through close collaboration with our technology partners, the team began to set build start and end dates for each sub-project deliverable. From there, we extrapolated testing timelines factoring in our testing management office’s four primary testing dependencies:

Test Environment availability

Test Data needs

Sub-project interdependencies

Resource Availability

We first had to be cognizant of the various test environments required and when each could be utilized. As it pertains to test data, we needed to understand how the data was being sourced and when the data would be available. To account for resourcing, we developed resource plans, which considered the availability and allocation of different parties in all facets of testing. As the merger was a large-scale project, we also had to factor in cross-workstream dependencies that were prerequisites to testing. Furthermore, the team had to consider how the bank’s competing initiatives impacted the test environment and resource availability and, in turn, our project’s test schedules. Each sub-project submitted its test plans to the test management office, which were reviewed to ensure alignment across the project and aggregated to formulate a comprehensive test plan for the merger.

BUSINESS VALUE

Applying an agile test governance framework can significantly streamline test execution through the deployment of the following:

Rapid Decision Making: Swift and decentralized decision making at the sub-project level

Adaptive Model: Testing models provide flexibility for continuous improvement and constant adaptability

Responsiveness to Change: Since the testing models feed on the BRDs, it is easy for sub-project leads to showcase the deliverables to stakeholders and receive expedited feedback, ensuring continuous improvement

“Just enough” Documentation: Straightforward testing documentation, considering full testing universe and key inputs

Visibility to the Stakeholders: Close collaboration with technology partners to promote their input into testing models and test schedules

Key Metrics and Continuous Improvement: Testing documents have clearly defined metrics and expected results, providing visibility for management about constraints and impediments

Further, the client was able to identify risks as early as feasible and meet its ambitious testing timelines.