Fig. 1

Machine learning (ML) has increasingly been delivering value for large financial institutions as they invest in the technology to attract new customers and streamline operations. Recent advances in the technology underpinning artificial intelligence (AI) have enabled financial institutions to explore the application of ML techniques in their client facing operations. The sector is quickly transforming as ML is now integrated into areas such as fraud prevention, customer service, marketing, investments and trading, as well as internal operations including risk management and testing governance. The list of applications will only continue to expand as leaders seek a competitive edge through innovations that improve the customer experience while supporting top and bottom-line growth. In fact, International Data Corporation (IDC) forecasts that spending on AI and ML will grow from $12 billion in 2017 to $57 billion by 2021 (Fig. 1).

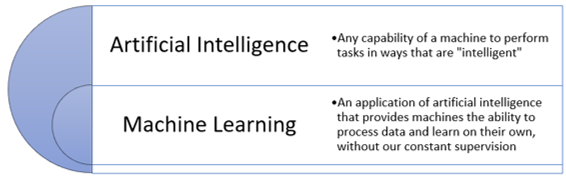

Differentiating AI and ML

The concepts of AI and ML are often used interchangeably; however, ML is actually a subset of AI. AI is the capability of a computer program to simulate intelligent behavior. This could be as simple as a computer application playing checkers against a random opponent or as complex as aggregating disparate data points to execute likely profitable trades. As a subset of AI, ML involves computer programs using information and data to process and learn for itself. A potential use-case of machine learning would be a robot playing multiple hands of poker against a human where the robot analyzes the person’s tendencies while attempting to accumulate the maximum amount of chips from the human opponent.

Source: Forbes.com

Machine Learning to Improve Operational Efficiencies for Broker-Dealers

The Qualified Financial Contracts (QFC) recordkeeping regulatory rule requires financial institutions to systematically link end of day trading positions, counterparties, collateral, and legal agreement information. A primary requirement of the rule mandates all legal agreements associated with QFC activities be stored in an electronic format. The rule also requires key information from these agreements (e.g. critical contractual provisions such as cross-default clauses) to be searchable. The complexity of identifying these requirements becomes particularly challenging with contracts that are geographically dispersed throughout the institution’s network of affiliates.

As part of a recent QFC governance program, an AI and analytics platform combined open source ML with advanced analytics to extract relevant content stored in an enterprise information management system. This program was implemented to conduct a full extraction of relevant clauses in all the bank’s QFC legal agreements. Once the applicable agreements were stored electronically in a central repository, the tool was used to discover the required fields in the contracts and ensure essential contractual provisions were searchable by the regulators in case of a bank failure. Similar to any machine learning technology, this application required a large volume of samples in order to consistently and accurately pinpoint the pertinent legal clauses in the agreements in order to satisfy the regulatory requirement. In the end, the tool successfully facilitated compliance with the recordkeeping requirements while providing the ability to generate automated reference sheets of documents associated with QFCs as well as automated tagging of contractual provisions.

While this is one use-case that has proven to deliver value by realizing cost savings and operational efficiencies, there are many more avenues for AI and ML to transform the financial sector. For example, anti-money laundering (AML) compliance costs for financial institutions in the US are estimated at more than $25 billion annually [1]. Leaders are looking towards AI and ML to make a transformational impact on the current rules-based and labor-intensive processes that dominate compliance with financial regulations. Similarly, as the world of quantitative trading continues to grow, large financial data sets are being leveraged to identify patterns that could be used to make strategically beneficial trades and deliver stronger profits.

As machine learning continues to advance, algorithms are becoming more complex as they are not only designed to simply analyze market behavior, but they are increasingly relied upon to develop a strategy, make predictions, and more. As use-cases for machine learning continue to expand and achieve further adoption across the financial services industry, Monticello is leading the market with AI/ML vendor analysis, management of AI/ML pilots, and management of full rollouts of these tools to support large programs of change. Monticello looks forward to supporting our clients as they look to expand through the implementation of these cutting-edge technologies.

Why Monticello?

Monticello Consulting Group is a specialized service provider with deep knowledge and expertise in regulatory reform along with business and digital transformation. Our understanding of the competitive forces reshaping business models in capital markets, lending, payments, and digital banking are proven enablers that support our clients to remain in compliance with regulations, innovate to be more competitive, and gain market share in new and existing businesses. By leveraging our core practice areas covering advisory, portfolio optimization & program management, Agile transformation, digital & advanced analytics, and testing governance for complex enterprise-level change, our firm continues to guide our clients in the deployment of the latest technologies while managing some of the most transformational programs of change.

[1] “https://bdtechtalks.com/2019/03/28/artificial-intelligence-kyc-aml-compliance/”

Get In Touch

LEARN MORE ABOUT MONTICELLO AND PURSUE OPPORTUNITIES WITH OUR TEAM