The Basel Committee on Banking Supervision’s (BCBS) Minimum Capital Requirements for Market Risk (MCRMR) represent the next challenge for banks’ market risk calculations. After several years of consultations, revisions, and impact assessments (see exhibit 1), the BCBS published the final rule of what was formerly known as the Fundamental Review of the Trading Book (FRTB) rules in January of 2019. Banks will be able to select between two approaches to use for calculating their risk exposures and capital requirements, but each entails a unique set of tradeoffs: the Standardized Approach (SA), whose one-size-fits-all models will generally require more capital, but comes pre-approved; or the Internal Models Approach (IMA) in which banks can tailor models to their businesses, but must pass onerous testing requirements to prove their model accuracy and adequacy. This choice can be made on a desk-by-desk basis, which lowers the stakes slightly, but may still dramatically hike capital requirements for certain business lines. Implementation of either approach will also likely entail significant technology investment and require banks to think strategically to optimize their approach.

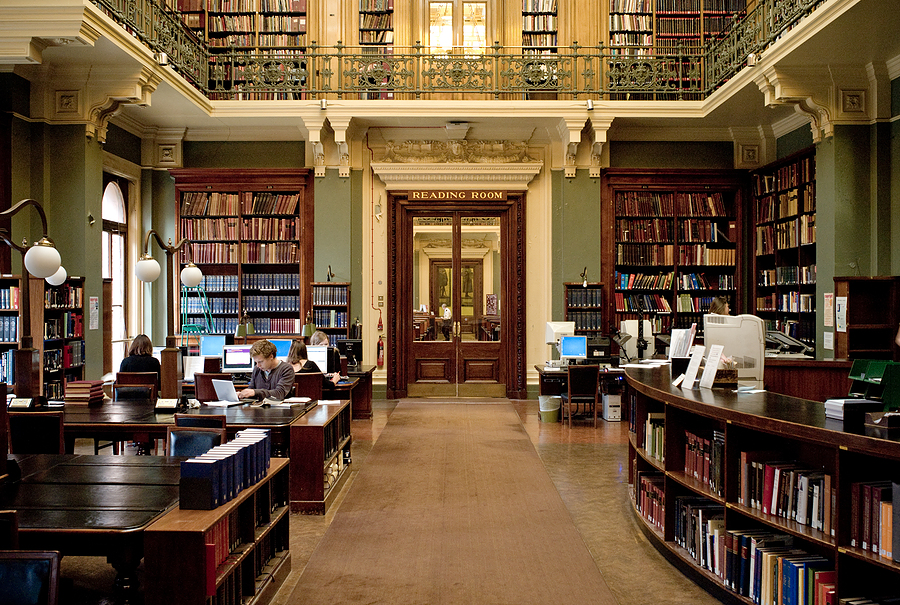

Exhibit 1

Emerging Standards

The idea for the new BCBS standards first emerged in the discussions around capital adequacy calculations included in the Basel 2.5 reforms that were passed in the wake of the financial crisis. While Basel 2.5 required computation of “Stressed Value at Risk” (VaR), it was acknowledged that this measure does not adequately capture tail risk, and therefore will tend to underestimate losses in a crisis. As a result, the BCBS proposed a new measure - “Expected Shortfall” (ES) – that better captures tail risk by focusing on the results of the worst-case scenarios, as a replacement for Stressed VaR.[1]

The BCBS also provided more stringent definitions to distinguish between “banking” and “trading” book exposures. This reduces banks’ ability to classify assets based on their own standards. The BCBS added a set of tweaks to the final rule published in 2019 and set a target compliance date of January 1, 2022. The final adjustments were relatively minor but made the adoption of IMA approaches slightly more attractive in most instances. The ball is now in the court of national regulators, most of whom are expected to implement market risk capital standards that are very closely aligned to the BCBS standards. It is not yet clear if all national regulators will stick with the 2022 implementation timeline given the plethora of external uncertainties, including COVID-19 and Brexit.

No Free Lunch

The key challenge facing banks in the years leading up to 2022 will be to make a determination between SA and IMA for each separate trading desk. Banks will have to consider both the capital impact and the resources required to qualify for IMA approval when making these decisions. Trading desks with large exposures and liquid products will find IMA a more attractive proposition than smaller and less liquid ones. Whichever approach banks choose, the new requirements are expected to have the effect of raising their trading costs on average – either through higher capital requirements, increased spending on implementation, or in some cases, both.

While the development, implementation and testing requirements needed for IMA are burdensome, they may be worth the effort for banks able to shoulder the upfront efforts and maintenance requirements. Impact studies performed by the BCBS show that the disparities between SA and IMA can be large, and in some cases have widened following the 2019 revisions. For example, FX capital charges using SA are expected to be 220% of those calculated under IMA. Some Singapore-based banks have estimated they can reduce their market risk capital requirements by up to a third by choosing IMA over SA.[2] Even within the US, the expected impact on banks’ market risk capital requirements range from a 58% increase for the hardest-hit quartile of firms to a 19% decrease for the least.[3] Overall, the BCBS expects implementation to increase market risk capital requirements by 22% on average, from ~4% of total Risk Weighted Assets under Basel 2.5 to 5%.[4] Variations in trading business models will mean that some banks will see an overall 2% decrease in required capital, while others may see increases over 8%. While this isn’t a massive change in total bank capital requirements, at the individual desk level there will be a significant impact on profitability depending on the capital charge and allocation approach applied by individual banks.

Choose Wisely

Although the capital savings of an IMA approach may seem like a tempting choice, banks need to be fully prepared for the onerous testing, approval and maintenance requirements if this path is chosen. The mandatory Profit and Loss Attribution Test, which compares back-office risk model results to trading desk pricing models, is expected to be especially challenging to implement. Adding to the difficulty, a failure to properly align the models’ results could force desks into using SA – even after spending the resources to implement their own models. In addition to demonstrating the forecasting accuracy of IMA models, banks will need to make significant investments into their data and systems infrastructures. Banks need to provide proof that model outputs are based on observable and validated market rates. Enhanced simulation requirements will place additional burden on risk systems as the number of required simulations under IMA is significant when compared to most banks’ current standard practices.

Rigorous prioritization and strategic evaluation will be crucial to support banks in making their choice between SA and IMA approaches for individual desks. For those who select IMA, proper governance and controls will need to work hand-in-hand with technical and regulatory expertise to ensure a successful outcome. Banks that effectively perform the required analysis and groundwork will benefit from both reduced capital requirements and a boost to their reputation for risk-management expertise.

About Monticello

Monticello consultants have extensive experience in the implementation of large-scale regulatory initiatives. Our firm understands the importance of diligent analysis, program management, and collaboration across teams within major financial institutions and across the industry. We work across the entire regulatory landscape and bring that expertise to bear for our clients. Our teams possess deep knowledge of capital markets instruments, legal agreements and operational processes, as well as the related data and information systems impacts that will be vital for firms meeting the BCBS guidelines, regardless of which approach they choose.

[1] https://www.bis.org/bcbs/publ/d457.pdf

[2] https://www.risk.net/media/download/1020731/download

Get In Touch

LEARN MORE ABOUT MONTICELLO AND PURSUE OPPORTUNITIES WITH OUR TEAM