Prior to the global pandemic, most banks and financial institutions were already on a path towards digital transformation. Ready or not, we are all now moving at a pace at which we never had to move before out of sheer necessity, and this has accelerated the digital transformation timelines by an estimated 3-5 years. The closure of bank branches and growth in work-from-home has driven bank customers to embrace digital banking channels. One-stop shop mobile applications and personalized customer service with real-time interaction is now the driving force behind successful customer engagement by retail banks. To further accelerate the digital transformation, banks continue to enhance the simplicity and transparency required to open a new account, support seamless deposits, and transfer money. Real-time financial advisory services have become readily available. Looking beyond retail and wealth management, enterprise-wide operations are streamlining processes and leveraging automation at an accelerated pace to meet the needs of employees and partner organizations. Needless to say, digital is everywhere, but success is by no means guaranteed. To improve success rates, many organizations have turned to design thinking as a key ingredient. But what exactly is design thinking and how are organizations leveraging the approach to outpace the competition and win with customers, employees and partner organizations?

Value of Design Thinking

Design thinking is a method of problem solving which uses a customer-centered approach to push the discovery of highly-nuanced consumer needs to the forefront of the innovation process. These needs are integrated with technology to identify and develop the best possible solution. Design thinking’s straightforward set of intuitive principles can help bring simplicity to complex business situations and aid companies in driving greater and more successful innovation to create products and services tailored to customers’ needs.

Given these benefits, it is no surprise that in the past few years, we have seen financial institutions increasingly incorporate design thinking into their products, leading to great leaps in technological capability and customer experience. While the consumer business was an early adopter, other areas of the enterprise such as sales and onboarding to regulatory technology and communications are now enhancing their innovation capabilities.

Incorporating Design Thinking into Operations

Many financial institutions have built their own innovation labs focused on Agile execution, but applying Agile to pre-existing everyday routines can be a struggle. These innovation labs were set up to solve a problem and build a solution; but in an environment where customer behavior and demands are constantly changing such as during the pandemic, the real need is to incorporate innovation and creativity into the everyday core routines of people, technology, and processes. There is now a focus on the fluidity of expectations where customer and employee needs are top priority every day.

Working day-in and day-out with business leaders and pushing them towards customer-centric thinking can motivate them to contribute and/or solicit ideas and feedback towards a prototype that takes into consideration the full value chain. While doing so, it is critical to keep in mind that the ultimate front-end customer experience of a product is only as good as the back-end operations that support it. In fact, our team recently leveraged design thinking with stellar results during an engagement with a global financial institution. In our most recent example, the time to onboard new customers was halved and the customer experience greatly enhanced – thanks to an enterprise-wide approach, cultural shift, and commitment to doubling down on customer insights. Let me share a bit more about the winning formula.

Putting Customer Empathy at the Forefront

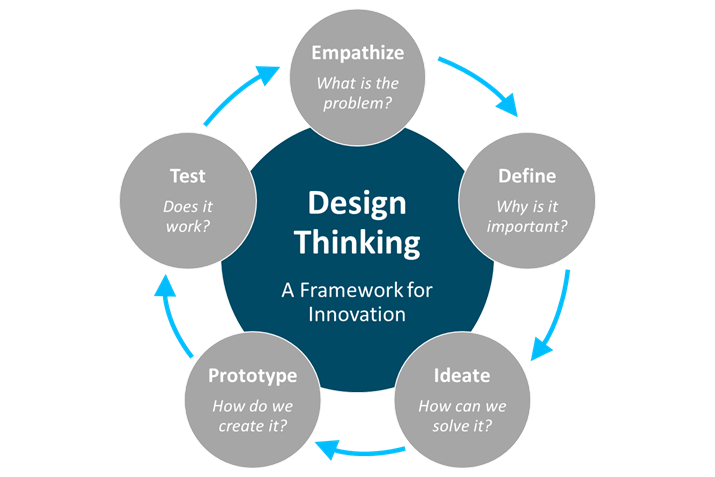

Empathy is essential to design thinking. It is the very first stage of the design thinking framework (Figure 1), followed by: Define, Ideate, Prototype and Test. Empathy is what helps organizations relate to the stories of their end users, understand their problems and model the firm’s strategy. Since the customer base will differ from bank to bank, financial institutions need to imagine beyond average users and see through the eyes of extreme users to design products that are unique, real, and measurable. This can be achieved through the concept of customer co-creation. Thus, through the iterative process of design thinking, banks and financial institutions can stay engaged with customers on a daily basis and improve their products and services continuously.

Figure 1: The Design Thinking Framework

Now more than ever financial institutions must transform. With proper training, the concept of human-centered design thinking can be embedded throughout the enterprise and with time become a cultural norm. With the right strategy and approach, financial services firms will be able to drive sustainable and resilient operations that drive innovation. Let’s hope that when the pandemic ends, we are able to sustain the current pace of innovation!

About Monticello

Monticello Consulting Group is a management consulting firm supporting the financial services industry through deep knowledge and expertise in digital transformation, change management, and financial services advisory. Our understanding of the competitive forces reshaping business models in capital markets, lending, payments, and digital banking are proven enablers that help our clients remain in compliance with regulations, innovate to be more competitive, and gain market share in new and existing businesses. By leveraging our design thinking and Agile capabilities, Monticello guides its clients in the deployment of the latest digital technologies with confidence and resilience.